Case Studies

Case Study

Tarzana Crossings

18362-18424 Oxnard Street, Tarzana, CA

Listed (Unpriced)- 2/17

Sold $18,500,000- 7/18

Tarzana Crossings was an older industrial complex consisting of four buildings totaling 90,000 square feet, on 4.25 acres, across from an Orange (Bus) Line stop. It qualified as a Transit Oriented Development site. The property was an owner/user medical lab for decades. When the owner retired, he rented it out to another major medical lab, then after they vacated, to movie production companies on short term rentals and leases.

He had it on and off the market for sale with numerous brokerage firms over 20 years, with no success. In fact, about 20 years prior to taking the listing to sell it, I had contacted him regarding the property. We put it on the market for an undisclosed price, mainly because the development market was still hot at that time. I believed that the property was worth between $18M-$19.5M. We received numerous offers below that, in the $14.5M-$16.5M range. I was convinced we could get more because it had 5 per 1000 square feet parking ratio, which was difficult to find; especially in this location.

We finally located our buyer who saw the vision I had for the property, which was for creative office space. We sold it at $18.5M, on a 45-day escrow.

Comerica Bank

Case Study

Comerica Bank

Los Cerritos Center

11355 South Street, Cerritos, CA

Listed for $6,900,000 12/18

Sold for $6,500,000- 5/19

The bank is in a 5,228 building on a 27,000 square foot out-parcel of a regional mall in Cerritos. The owner was divorcing and was disposing of his investment properties.

He had written a very high lease rate for the bank, with built in rent bumps. The lease rate was about 20% above market. He had it on the market with another broker who could not produce any offers. I asked him if he’d let me give it a try. I believed that it was a great investment, with upside should the bank not renew their lease at the end of their term in three years.

I took it out to market and received some resistance on pricing from many of the buyers. I knew that it would take a certain type of buyer to recognize its inherent value. I touted it as a ‘legacy’ property, due to its corner location on a busy intersection of the regional mall. I located that buyer. They told me that is what they were looking for.

As it turned out, it was the highest per square foot price of a net leased bank property sold in LA County, as of May 2019, at $1618/sf.

Citibank

Case Study

Citibank

1275 W. Redondo Beach Blvd., Gardena, CA

Listed for $5,900,000- 6/19

Sold for $5,770,000- 10/19

This bank branch was in a 14,000 square foot, two-story building, on a little over an acre of land. The owner purchased it four years earlier in a 1031 exchange. She now wanted to sell because her partner wanted out. She called five other commercial brokers who specialized in net leased properties. They all gave her opinions of value in the 5-5.75 cap rate range, due to the fact there was nine years left on the lease at a much below market rental rate. She received one of my mailers on a Comerica Bank I sold in Cerritos. I met with her and went over the details of her property and I came to an opinion of value for her at 4.25-4.5 cap range. She was surprised based on her other opinions of value received. This valuation was based on my believing that the additional land that was there was a terrific mixed-use development project site for the future.

I located a buyer who saw the vision I presented and he decided to make an offer. It sold for a 4.25 cap rate, netting her an additional $850,000 more than her next best other broker opinion of value.

Baywood Court Retail Center

Case Study

Baywood Court Retail Center

24121-24133 Baywood Lane, Valencia, CA

Listed for $5,925,000- 3/16

Sold for $5,600,000- 7/16

The property is a well-located strip center in the community of Valencia. It was purchased shortly after it was completed in the late 90’s, when it was fully leased.

The property was minimally maintained, with significant deferred maintenance, and under-managed. The owner was elderly, and wasn’t fully aware that she had accepted one of the hard money checks that are sent out by “less than scrupulous” lenders. She deposited it, and eventually the loan became due. She was not prepared to fully deal with it when she was told by the lender they were foreclosing on the property. I stepped in and found another lender who paid it off, and I then took the property out to market. It also had a vacant unit.

Fortunately, I found a buyer who wanted to own in the area and stepped up and paid a higher price. I convinced him that the seller would guarantee the rent on the vacancy for a one-year period, unless we got it leased with a tenant he would accept, which we did. She ended up doing a 1031 Exchange with it, buying another strip center with all national chain tenants in it, under construction, in another state. She increased her cash flow $48,000 a year.

4343 Lankershim Blvd.

Case Study

4343 Lankershim Blvd., North Hollywood

Purchased for $11,500,000- 11/20

Sold for $33,400,000- 10/21

The building is a 33,000 square foot office building, built in the early 90’s, as an owner-user building, with upgraded finishes. The property was on the market for over a year and a half with a major brokerage company. They had a couple of price reductions and offers, but with no success.

We presented it to a buyer under the assumption it could possibly be converted to medical office. It turned out he had made an offer on it previously, but could not make it work as a conventional office investment. When I explained to him how he could potentially get the parking he needed to qualify for medical office use from a church located across the street, he made another offer. I negotiated the price and terms, and he was able to finalize a parking agreement with the church. He then purchased it.

He successfully landed a credit medical tenant that filled the building. About a year later he received an unsolicited offer for over $33,000,000.

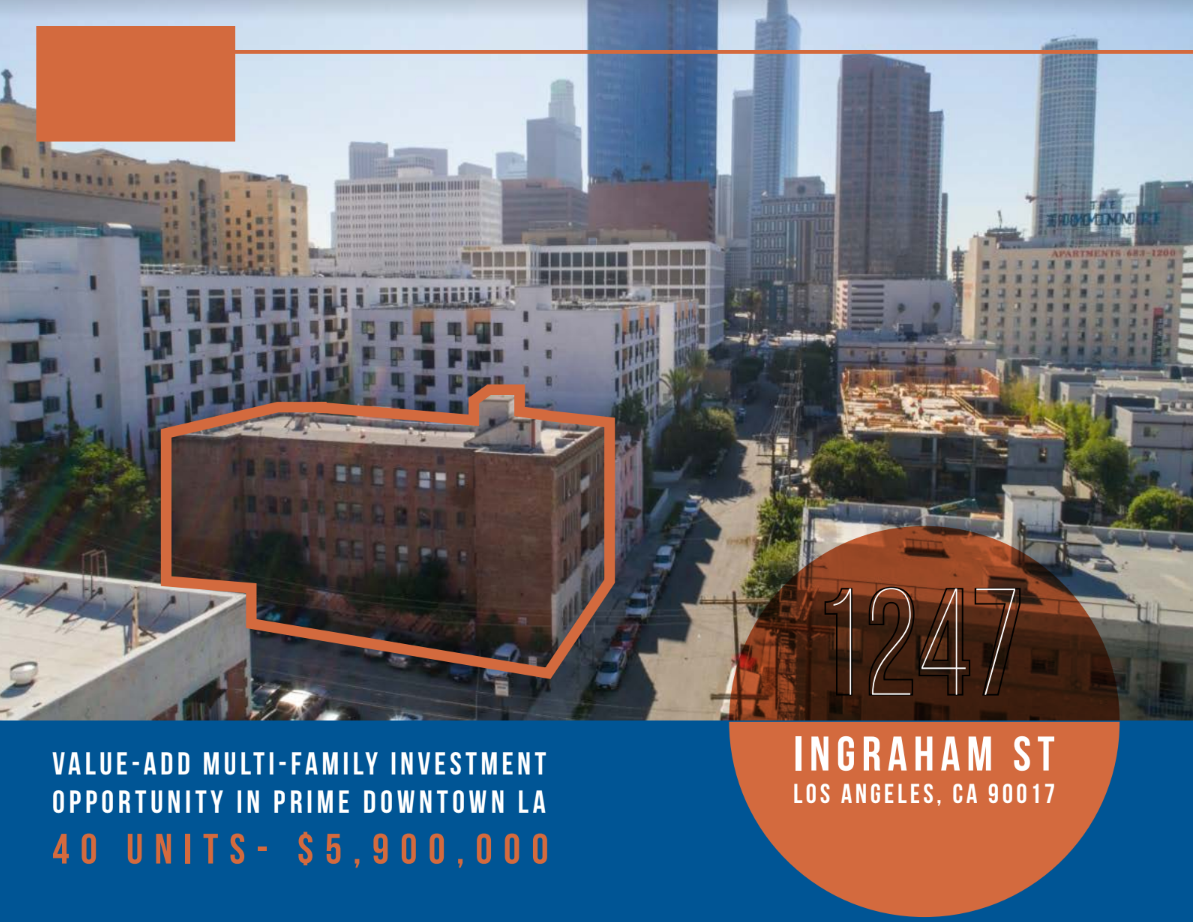

1247 Ingraham Street

Case Study

1247 Ingraham Street, Los Angeles, CA

40-Unit Apartment Building

Listed for $5,900,000- 12/21

Sold for $5,850,000- 2/22

This is a historical apartment building built in the 1920’s downtown Los Angeles. This is located in an area that has low vacancy and has high demand from investors. The owners had it listed with two other major brokerage firms. Neither of them could successfully close the transactions they had in escrow with it. A friend of mine who is a commercial real estate broker referred them to me. They were frustrated that they couldn’t get a transaction completed. I knew that this was a property that should not have a problem selling.

I put together an offering memorandum with all the information that justified pricing and the area. I put it back on the market and found an exchange buyer who had other properties in the area. The next day he toured the property with his broker. I had another broker call me that said he wanted to show it the next day. After that tour I called the broker with the exchange buyer and told him I just had a tour with another broker and his client. The client expressed strong interest and said he would be writing an offer. Shortly after, I had an offer close to full price from the exchange buyer. We had a quick due diligence period negotiated, with a large earnest money deposit released to the sellers, then closed not long thereafter.